ABOUT US

What We Do

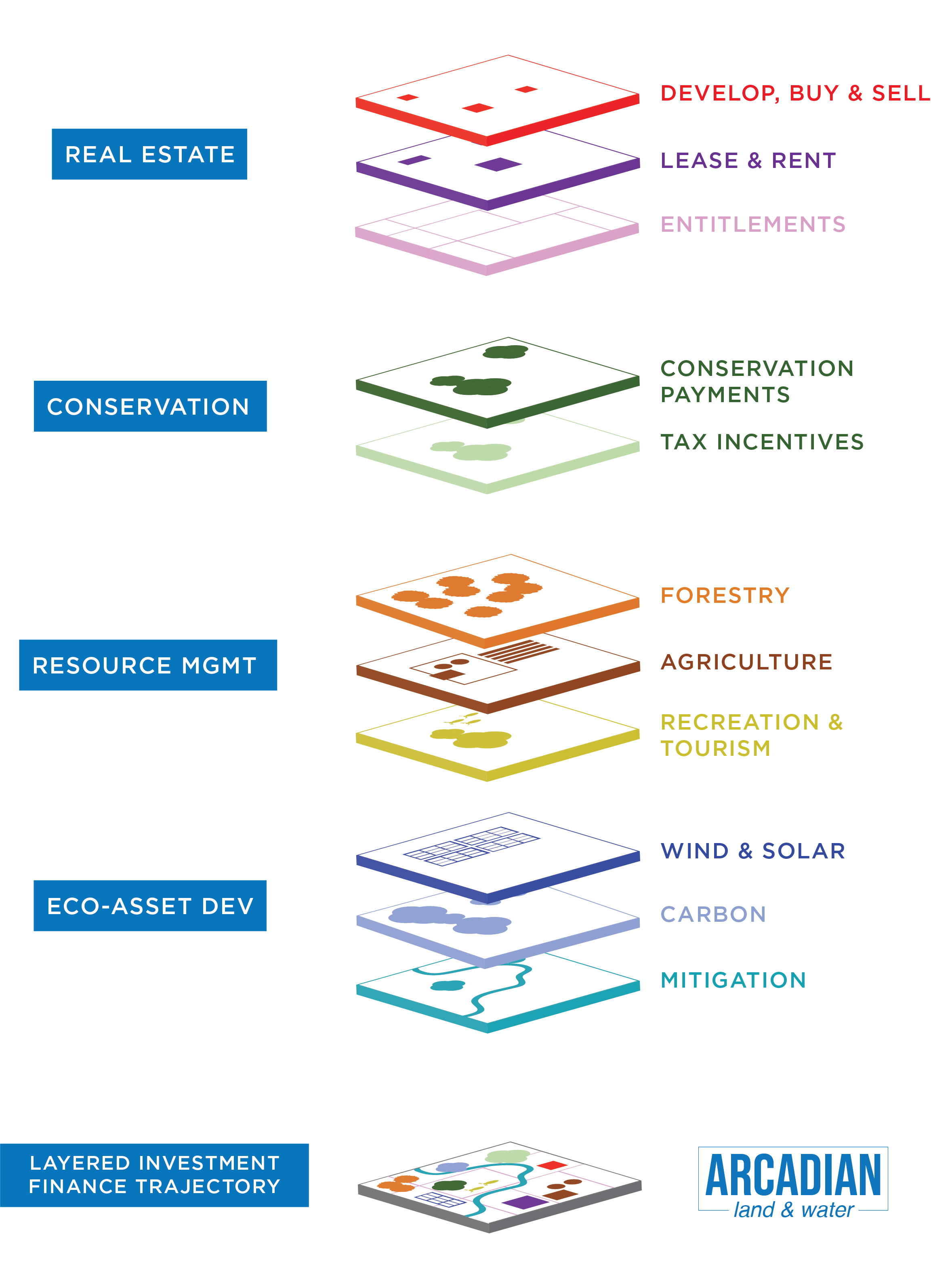

Our process of investing in, stewarding and developing real estate assets centers around the concept of “a mosaic of opportunity.” We believe complexity breeds opportunity, and discovering opportunities is what we do best. We employ the strategy of layering complementary revenue streams from traditional real estate revenue sources (agriculture, silviculture, recreation, and development) with alternative revenue sources (ecosystem assets, green energy conservation, and tax incentives). We invest in long-horizon, natural resource markets within large scale real estate portfolios. This strategy allows Arcadian to unlock value that would otherwise remain latent and generate a unique blend of diversified financial returns.

Our Unique Approach

Pulling from a unique mix of natural resource investment and land management experience, Arcadian creates a “mosaic of opportunity” for our investors and investment partners. The Arcadian Principals have spent the better part of two decades providing asset management and real estate advisory services to a diverse array of real estate developers, investors and owner-operators located throughout the country. We specialize in the following giving our investors a wider range of potential revenue streams:

Forest and timber management

Forest carbon offsets

Wetland and stream mitigation

Endangered species mitigation

Land and resource conservation strategies

Alternative energy development

Leveraging public resources for private natural resource management

Real estate development

Our Industry Experience

Over our 40+ years of combined experience in purchasing and managing land assets, we have transacted over $1B in unique property investments on over 100,000 acres of land in multiple states. We have also restored, mitigated or conserved over 300,000 acres of land on properties we have managed or invested in. As part of our comprehensive strategy, we not only monetize property through diversification, we also fund property management and return profiles through obtaining funding from the private, public and non-profit sectors.